Blog

Dec 23, 2024

Top 5 Strategies for Streamlining Your Small Business Payroll

Simplify payroll with actionable strategies. Ideal for small business owners to save time and reduce errors.

Dec 23, 2024

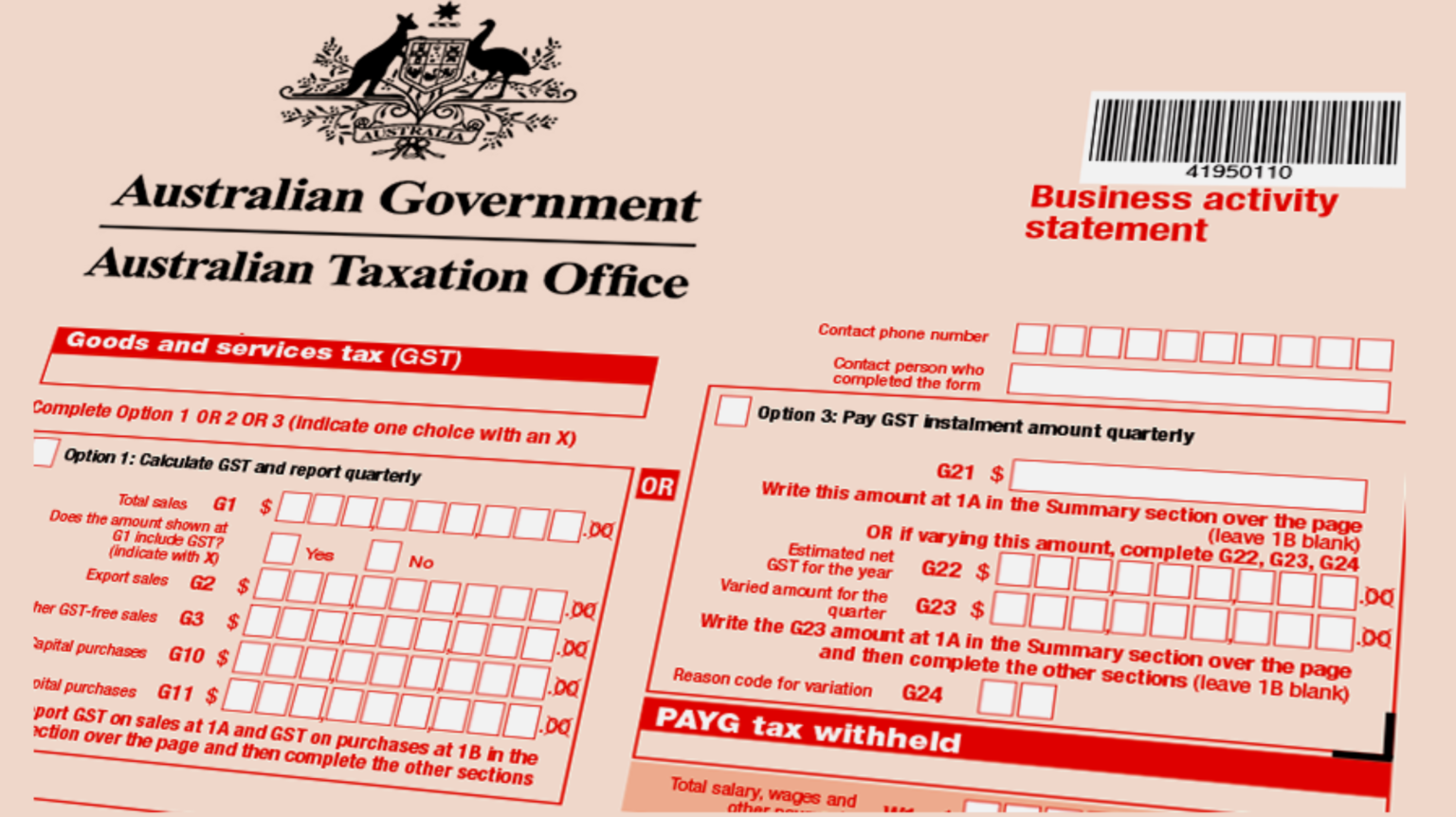

BAS Lodgement Mistakes (and How to Avoid Them)

Learn how to file your BAS accurately with our step-by-step guide. Stay compliant and stress-free. Businesses must report the amount of GST they’ve collected on their sales and the GST they’ve paid on their purchases.

Dec 20, 2024

A Comprehensive Guide to DIY Bookkeeping

Master your finances with this beginner-friendly guide to handling your business bookkeeping. DIY bookkeeping is the process of managing your business’s financial records on your own, without hiring a professional accountant or bookkeeper.

Dec 20, 2024

7 Hacks to Find a Competent & Technology-Proficient

Proactive collection strategies ensure prompt payment recovery, minimizing bad debt risks. BAS accounting typically involves recording all transactions related to these areas and ensuring they’re reported correctly in the statement.

Dec 12, 2024

Tips for Better Financial Management

Lodging your Business Activity Statement (BAS) accurately is crucial for complying with Australia’s tax laws. The BAS is used to report and pay various tax obligations, including Goods and Services Tax (GST), Pay As You Go (PAYG) withholding, and other taxes. However, the complexity of BAS can lead to errors that might result in penalties, […]

Sep 13, 2024

8 Common BAS Lodgement Mistakes (and How to Avoid Them)

Lodging your Business Activity Statement (BAS) accurately is crucial for complying with Australia’s tax laws. The BAS is used to report and pay various tax obligations, including Goods and Services Tax (GST), Pay As You Go (PAYG) withholding, and other taxes. However, the complexity of BAS can lead to errors that might result in penalties, […]

Aug 17, 2024

Complete Guide to BAS Lodgement: Step-by-Step Process and 7 Common Mistakes to Avoid

Running a business in Australia comes with numerous responsibilities, one of the most crucial being the lodgement of Business Activity Statements (BAS). BAS lodgement is a key aspect of business compliance, required by the Australian Taxation Office (ATO). Whether you’re a small business owner, a sole trader, or manage a large corporation, understanding how to […]

Jul 31, 2024

The Ultimate 9-Step Checklist for Year-End Single Touch Payroll (STP) Finalisation

Closing the year-end payroll in Single Touch Payroll (STP) is a meticulous task that requires thorough attention to detail and strict adherence to the Australian Taxation Office (ATO) requirements. This comprehensive checklist covers each essential step, ensuring a smooth and compliant year-end payroll process. Table of Contents 1. Review and Update Employee Information 2. Reconcile […]

Jul 24, 2024

DIY Bookkeeping for Australian Small Businesses: A Comprehensive Guide

Starting a new business in Australia is an exciting venture, but it also comes with numerous responsibilities. One of the most crucial aspects of managing a business is keeping accurate financial records. While hiring a professional bookkeeper is an option, many small business owners opt for DIY bookkeeping to save costs. This comprehensive guide will […]

Jun 17, 2024

5 Essential Tips for Organizing Your Business Financial Records

As a business owner, staying on top of your financial records is not just good practice; it’s essential for your business’s success. With the right organization, you can save time, reduce stress, and make informed financial decisions. In this quick-read blog, we’ll share five valuable tips to help you streamline and manage your financial records […]

Jun 17, 2024

Bookkeepers vs. Accountants: Understanding Their Crucial Roles in Your Business

As a small business owner, you wear many hats. But when it comes to financial matters, you may need some expert help. Two key players in your financial team are bookkeepers and accountants. In this brief guide, we’ll demystify their roles, helping you understand when and why you need their services. Table of Contents 1. […]

Jun 17, 2024

Understanding Financial Statements Made Easy

As a small business owner, you’re busy running your company, but you also need to keep an eye on your finances. Financial statements might sound complex, but they’re crucial for your business’s success. We’ll break down the essentials of three key financial statements: income statements, balance sheets, and cash flow statements below. Table of Contents […]

Jun 17, 2024

7 Hacks to Find a Competent and Technology-Proficient Bookkeeper Without Breaking the Bank

In the fast-paced world of small business, managing finances efficiently is paramount to success. A competent and technology-proficient bookkeeper can be a game-changer, ensuring accurate financial records and providing insights that can help drive strategic decisions. However, for many small business owners, the cost of hiring such expertise can be a concern. This article will […]

Jun 17, 2024

Streamlining Payroll for Australian Small Businesses: A 6-Step Guide

Navigating employee payroll processing for your small business can be a challenge. In this quick guide, we’ll break down the essentials in just 6 steps, helping you manage payroll efficiently. Table of Contents 1. Collect Employee Info 2. Choose a Schedule 3. Calculate Gross Pay 4. Deduct Taxes and Superannuation 5. Issue Payments 6. Maintain […]